What if we told you that a single individual customer could be worth over $10,000 to your business? Or that a small boost in retention could double your profits?

What if we told you to stop focusing myopically on one-off sales and reap the rewards of ongoing, long-term relationships?

As businesses, we often get hung up on day-to-day transactions without seeing the lifelong potential in our customers.

In this article, we'll show you how to shift focus to the big-picture relationship with customers rather than the individual sales. You'll learn how to calculate the revenue you can expect over the entire lifespan of your average customer – with an insightful metric called customer lifetime value (CLV, or CLTV).

So buckle up because, in this article, we’re going to go into:

- What customer lifetime value is

- Why businesses calculate CLV

- 8 ways to increase CLV

- How CLV and CAC are related

- Common FAQs

What is customer lifetime value?

Customer lifetime value is an important metric that marketing teams utilize to understand and optimize customer relationships for long-term revenue growth.

It refers to the total revenue a company can expect from an average customer over the entire lifespan of their relationship. For a revenue marketing team focused on customer retention, cross-sells, and up-sells, understanding CLV is crucial.

A high lifetime value signifies that your marketing efforts are effectively communicating ongoing product/service value, which leads to customers making repeat purchases over time.

Revenue marketers can influence CLV by developing campaigns and content that:

- Reinforce product-market fit and value proposition

- Educate customers on new features/offerings

- Nurture customer relationships to maintain satisfaction

But what does the customer lifetime value metric genuinely mean?

Well, for starters, an increasing customer lifetime value shows that your marketing efforts are working effectively. As campaigns and content continue highlighting product value and new features that solve customer needs, your average customer will spend more over time and stick around longer.

A win for sustainable revenue growth.

Segmenting customers by CLV also allows revenue marketing teams to differentiate and personalize messaging. The highest lifetime value segments can receive more proactive VIP marketing – exclusive content, premium offers, white-glove nurture streams, etc. In this way, CLV data guides decisions that directly impact revenue growth and churn reduction.

With customer lifetime value as a core metric, revenue marketing has a North Star for goal-setting and optimizing for long-term customer value creation.

Why customer lifetime value is important

You’d be forgiven if you sneered slightly at its name, “customer lifetime value” – it sounds like a string of buzzwords. After all, “customers” and “value” are the two pillars of any customer-first business. But “lifetime”? It sounds a little Hallmark-y, right?

Jargon skepticism aside, this little metric packs a lot of punch. In fact, customer lifetime value represents a crucial metric that enables companies to make smarter decisions around investing in customer acquisition and retention.

At its core, customer lifetime value quantifies how much revenue can be generated from a customer relationship over time.

With this long-term outlook calculated, companies gain an informed understanding of customer profitability. This drives more strategic prioritization of spending on both acquiring and retaining different customer segments.

Knowing the lifetime value levels of current customers provides an anchor point for how much effort and budget should be allocated per new customer brought in.

Acquiring a new customer for $100 makes sense if the CLV in that target market is $500 over several years. Similarly, CLV signals appropriate spending limits for retention programs for various customer cohorts.

High lifetime value customers warrant bigger investments into loyalty initiatives and account management teams. Customers with lower CLV still deserve personalization but within tighter budget constraints.

Essentially, customer lifetime value enables companies to match acquisition and retention investments to future payoffs.

Why calculate customer lifetime value

There are many perks for calculating customer lifetime value. For one, having an assigned CLV to a customer allows a company to determine their long-term worth.

This enables companies to determine how much should be spent on customer acquisition costs. No company wants to break the bank by overspending on expensive marketing and promotions. They want to acquire customers profitably, and knowing customer lifetime value helps assess this.

4 ways CLV informs customer success decisions

Customer lifetime value has become a key metric in guiding revenue marketing decisions.

Optimizing CLV requires understanding how to engage, educate, and cross-sell/upsell customers in ways that fuel lasting, high-value relationships.

To effectively leverage CLV data, take a look at these four actions:

- Prioritizing marketing campaigns and content

- Optimizing renewals

- Enhancing customer engagement

- Informing marketing processes

1. Prioritizing marketing campaigns and content

CLV helps identify your most valuable customer segments to prioritize campaigns, personalized content, and marketing budget allocation.

2. Optimizing renewals

Since customer lifespan significantly impacts CLV, facilitating renewals through targeted marketing is essential. Revenue marketing plays a key role in articulating product value for renewals.

3. Enhancing customer engagement

Upsell and cross-sell marketing should be an ongoing focus, not just for new acquisitions. Revenue marketers must intimately understand usage, needs, and potential to provide relevant content.

4. Informing marketing processes

Declines in CLV for segments may signal a need for new marketing approaches, messaging, or content types. Revenue teams can diagnose pain points and potential gaps, and then advocate necessary improvements to support CLV growth.

Utilizing CLV for revenue marketing

Why else should companies calculate CLV? Well, CLV goes hand-in-hand with segmentation strategies.

Knowing which of your customers generate the most value through high CLV is also important for revenue marketing teams. It allows you to prioritize messaging, offers, and campaigns for the most profitable customer segments.

Additionally, having detailed CLV data can be valuable for companies looking to be acquired, as it demonstrates the revenue potential of the existing customer base.

Customer lifetime value formula

So, you want to find out how fruitful your customer is going to be? It’s a great question and one that can be solved with a simple formula.

- Determine the average purchase value by looking at total revenue from a customer cohort divided by purchase frequency over a set timeframe.

- Identify the typical customer lifespan or churn rate, which shows how long the average user stays active before leaving.

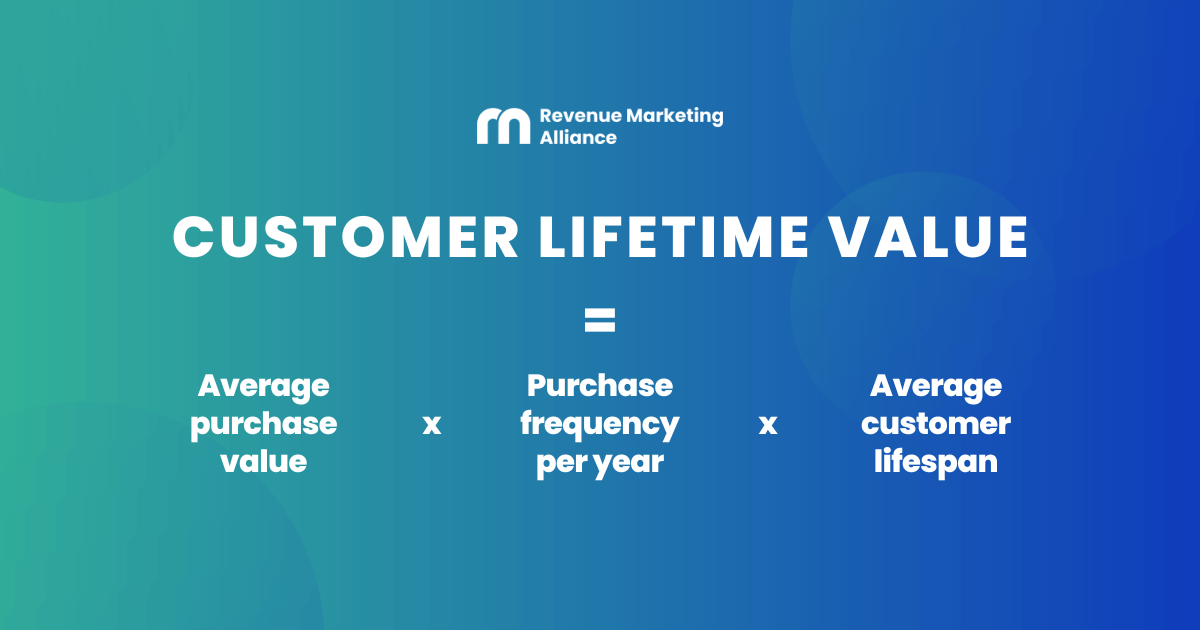

With these numbers, plug them into the CLV formula:

(Average purchase value) X (Purchase frequency per year) X (Average customer lifespan) = Customer lifetime value

For example, if a client has an average purchase of $1,500, buys once a year on average, and stays for three years before churning, the math is:

($1,500) x (1 purchase) x (3 year lifespan) = $4,500 CLV

Here’s a handy customer lifetime value calculator from CSC to help you work out your own customers’ lifetime value:

This calculator is designed to give you a quick and easy way to estimate the lifetime value of your customers.

By inputting a few simple figures – the average purchase value, purchase frequency per year, and average customer lifespan – you can gain insight into the total revenue you can expect from a single customer over the course of their relationship with your business.

Use this calculator to inform your decisions and strategies. Whether you're looking to adjust your pricing strategy or optimize your marketing campaigns, knowing your CLV is invaluable.

To make this calculation process smoother at scale across all customer segments, companies leverage dedicated CLV modeling software.

Solutions like ChartMogul and ProfitWell use historical transaction data to output customized CLV reporting. This eliminates manual formulas by automatically monitoring changes in buying behavior and churn dynamics. The software also helps segment users into tiers based on their predicted lifetime value, enabling more targeted retention initiatives.

Automating CLV not only saves time but provides dynamic insights to build longer-lasting and more profitable customer relationships over time.

8 ways to increase customer lifetime value

Growing your business through better retention and customer revenue growth should always be a top priority.

But how exactly? Well, we’ve got eight proven tactics to pump up lifetime value…

1. Cross-sell and upsell

Analyze purchase patterns to uncover likely complementary products for each customer. Then, prominently suggest bundles and deals to encourage add-ons at checkout.

Big spenders love a VIP offer – grant exclusive trials or discounts on premium tiers.

2. VIP marketing treatment

Develop exclusive marketing campaigns, premium content, and personalized outreach for your highest CLV customer tiers.

3. Loyalty programs

Implement loyalty and/or rewards programs that incentivize customers to continue purchasing through points, members-only content, elite status tiers, etc. Market these programs through targeted campaigns.

4. Listen up

Check the pulse of your customers every quarter through interviews and surveys. You can compensate customers for their time and candid insights by incentivizing surveys.

After curating your feedback, make sure you action it by improving products, upgrading features, and tackling glitches.

5. Omnichannel alignment

Ensure consistent messaging, branding, and customer experience across all marketing channels – website, email, ads, social media, events, and so on.

6. Build a community

Another great way to foster a positive experience for your customers is to spark connections through forums, advisory groups, and brand ambassadors. You’ll find that cultivating user groups with like-minded customers empowers them to co-create value.

7. Members attract members

With a membership model, you can pay members who refer new customers that convert – either issue account credits, discounts on next purchases, or cash rewards. You can then spotlight referral wins and offer double payouts for upselling new recruits. Not too shabby, right?

8. Appreciation upgrades

Everyone loves an upgrade. You can surprise loyal customers nearing renewal dates with a free extension of current packages or preemptive bump-ups to next-tier plans.

CLV + CAC: Customer lifetime value and customer acquisition cost

When you talk about the overall value of the course of a customer relationship, you can’t escape comparing it to the initial cost of landing that customer.

There’s no way to slice it; customer lifetime value must be analyzed in tandem with customer acquisition costs (CAC) to get the full picture of that customer.

When we talk about CAC, this metric encompasses every cent of the money you plowed into attracting that new customer through advertising, promotions, and special offers. The CLV metric only makes sense when weighed against the upfront CAC spend per customer.

For example, if a clothes store spends over $1,000 in CAC to bring in a customer with a $1,000 CLV, it may lose money overall. The store would need to lower acquisition costs in this case unless it can increase the CLV through retention and engagement efforts.

Carefully monitoring CAC is crucial to profitable CLV growth.

Additionally, the cost to serve a customer must be tracked over their lifetime. This operating expense involves order logistics, brick-and-mortar overhead, contact center costs, and more. Businesses can compare serving costs of high lifetime value customers vs. low ones. If the cost to serve an existing customer becomes too cumbersome over time, the business may face declining profit margins despite the customer's initial healthy CLV.

For subscription businesses, serving costs may be front-loaded in the first year of a contract but decrease as the tenure extends. Thus, improving renewal rates lowers the average cost to serve.

TL;DR: Continually tracking CLV, CAC, and cost to serve side-by-side for each cohort paints an accurate picture of customer economics. This analysis ultimately optimizes growth strategies to maximize profitability behind the revenue growth.

FAQs

What is customer lifetime value?

CLV is the total revenue a business can expect from an average customer during the entire relationship. It estimates the financial value each customer provides over time.

Is CLV the same as LV?

In practice, when discussing customer relationships and their value to a business, CLV and LV are generally considered the same. The choice between using CLV or LV often comes down to personal or industry preference for terminology. The critical concept behind both terms is the importance of understanding and optimizing the revenue potential from business relationships or assets over their entire lifetime, not just at a single point in time.

Why is understanding CLV important for business strategy?

Knowing the CLV helps businesses determine optimal spending for customer acquisition and retention. It also identifies the most valuable customers to focus on. Additionally, CLV enables more accurate revenue forecasting and provides insights to improve products driving loyalty.

How do businesses calculate customer lifetime value?

The basic calculation multiplies average purchase value, purchase frequency, and expected customer tenure. More complex models also incorporate acquisition costs, profit margins, and time value of money metrics.

Does CLV vary significantly between industries?

Yes, CLV varies greatly depending on sales cycles, repurchase habits, and customer retention levels within each industry. Subscription services often have higher lifetime values than big-ticket retailers, for example.

Is it better to acquire new customers or retain existing ones?

Retaining existing customers is more cost-effective and profitable. Increasing retention by just 5% can boost profits from 25% to 95%. Balancing acquisition and retention is best, but the CLV shows focusing on existing customers generates more value.

How do customer feedback and technology impact CLV?

Customer feedback allows businesses to improve products and services, leading to higher satisfaction and CLV. Technology like customer relationship management (CRM) systems and marketing automation provide insights to better understand customers and optimize interactions to increment lifetime value.

What are the key takeaways for CLV?

The lifetime value metric is essential for customer-centric decisions that increase revenue. It quantifies loyalty and guides profitable growth strategies for long-term success. Mastering CLV management maximizes the value extracted from each customer.

What have we learned?

Well, we've covered a lot of ground on the winding road of customer lifetime value. Hopefully, you've realized CLV is far more than a buzzword by now – it's a pivotal metric guiding smarter growth decisions.

While the math behind it may appear complex, the implications for your business are simple:

- Quantify loyalty to focus retention efforts

- Balance acquisition costs against future payoff

- Segment users to differentiate engagement

- Continuously listen and improve experiences

- Automate analysis for dynamic insights

See, boosting CLV shows customers you value the relationship, not just the transactions.

The brands that flourish are those who master these human connections and appreciate that CLV is earned through mutual understanding over time. They go beyond surface-level personalization to foster genuine bonds.

So, rather than chasing each new shiny thing, invest in what you have. Optimize for lifetime collaboration, not one-time sales. The rest will follow.

At its core, CLV represents potential. With the right foundation, a single loyal customer can be worth everything. And that's a metric you can take to the bank.

Want to have your say on customer acquisition in 2024?

Our comprehensive 2024 Customer Acquisition and Marketing Attribution Survey will reveal the inner workings of today's state-of-the-art revenue engines.

This is your exclusive opportunity to shed light on:

- Current marketing attribution challenges

- Where budgets should be allocated

- The evolving customer journey

- How teams track and optimize funnel performance

- The channels that attract and convert customers

- Key focus areas for growth in 2024

… And a whole lot more.👇

Complete the survey to get your hands on this practical, comprehensive slide deck to systematically optimize your entire revenue funnel.

Follow us on LinkedIn

Follow us on LinkedIn